Liquor License

The Alcohol and Gaming Commission of Ontario (AGCO) is responsible for administering the Liquor Licence Act (LLA) and specific sections of the Liquor Control Act (LCA), which, together with the regulations made under them, establish the licensing and regulatory regime for most aspects relating to the sale and service of alcohol in Ontario.

Among its responsibilities in the alcohol sector, the AGCO licenses and regulates establishments that sell or serve alcohol to the public for on-site consumption. This includes establishments such as bars, restaurants, lounges and nightclubs, although there are no restrictions in the LLA on the type of business that can apply for a liquor sales licence.

Visit the Municipal Liquor Sales Licence page from the AGCO for more information, forms, and resources to help you better understand licensing laws and requirements.

As part of the alcohol and gaming application process, a municipal information form must be signed by the city clerk, as well as agency letters of approval must be attached to the application from the City’s fire/rescue department, building department and the Hastings and Prince Edward Health Unit. Please note that the Hastings and Prince Edward Health unit is a separate entity, and this agency letter of approval can be requested directly from them.

Please note that the City of Quinte West requires a copy of the application submitted to AGCO to gain city council approval. Your request is circulated to the appropriate departments, and the comments are summarized in a report and sent to a council meeting for approval. Once city council has approved, the city clerk can sign the municipal information form in principle. At this time, the form and agency letters of approval will be sent to the applicant.

Charitable lottery licensing

A licensed lottery event can help charities and/or non-profit organizations raise funds to support local programs and services that benefit the local community here in the Quinte West. A charitable lottery licence is administered by the local municipality but regulated by the Alcohol and Gaming Commission of Ontario (AGCO).

The lottery licence officer in the City’s clerks department is responsible for issuing lottery licences to eligible charitable organizations for bazaar, bingo, break-open tickets, raffles, and other lottery events. Lottery licenses are required if money is paid for a chance to win a prize. A lottery event has the following three components; A prize, a chance to win the prize, and a fee.

The licencing office will determine the eligibility of your organization you are applying to. Charitable registration with Revenue Canada or incorporation as a non-profit organization does not guarantee eligibility for licences.

Your organization may be eligible if it:

- It has a purpose to provide charitable services to Ontario residents to relieve poverty, advance religion, advance education, and/or benefit the community.

- Has carried out activities consistent with its charitable purpose for at least one year

- It is located in Ontario

- Is non-profit

Examples of eligible organizations may include:

- Hospitals;

- Service clubs;

- Youth activities or sports; and

- Arts or culture.

Organizations that only promote the private interests of their members do not qualify for gaming event licences. This may include, but is not limited to:

- Adult recreation or sports;

- Individual sports teams;

- Unions or employee groups;

- Social clubs;

- Professional associations; and

- Political, government, lobbying or advocacy groups.

Applicants wishing to apply for a lottery licence must ensure that they read and understand your event licence terms and conditions before proceeding with an application.

- Application is for charitable gaming event licence only, administered by the licencing officer from the City of Quinte West.

- Applications are recommended to keep a copy of all licence application documents for their records; and

- Activities are regulated by the Criminal Code of Canada, Section 206 & 207, Ontario Order in Gaming Control Act 1992, and Regulations; and

- Applicants can obtain copies of the Gaming Control Act, Regulations, Provincial Information Bulletins, and forms from the Alcohol and Gaming Commission of Ontario’s.

- Your licence application is a legal document and will be returned or delayed if the instructions are not followed. If any of the items required in the application (as listed in each lottery type below) are missing, this may result in the cancellation of your charitable gaming event; and

- The City of Quinte West requires a minimum of five business days to process an application and fifteen days for first-time licensees; and

- Type or legibly print all information;

- Answer every question completely; and

- Applications must be submitted with original forms and signatures. Persons signing any licence application must have a good knowledge of the Licence Terms and Conditions, and lastly,

- The lottery licence fee must be made payable to the City of Quinte West.

Please note that all information, including appropriate documentation and fees, must be included in your application. Incomplete applications will be returned to the organization. Organizations cannot print or sell tickets until you are licenced, and all tickets must indicate the licence number. It is your responsibility to notify the Lottery Licence Officer of any changes to your organization, such as changes to your Board of Directors, changes in programs and services etc.

Application changes:

Suppose your organization needs to make changes to the licence application before submitting it to the licensing officer. In that case, each change must be initialled on each document by the licence applicant signors and other signors. Changes to your submitted licence application must be made in writing on your organization’s. In that case, Suppose letterhead, signed by the licence applicant signors, and include the documents that are affected. Please note that the City of Quinte West requires at least two weeks of written notice to consider change requests. Application changes are not automatically approved and may not be permitted. Once your lottery licence is issued, requests for changes will not be considered. Expired licenses may not be amended or cancelled.

Application renewals:

Organizations must submit their renewal applications to the licensing officer at least ten calendar days before the lottery licence expiry. This will allow applications to be given full and proper consideration by City staff.

Lottery Licensees are required to deposit proceeds derived from lottery events into an account designated as a trust account by the financial institution in which it is held.

Designated lottery trust accounts

Licenced organizations are required to have a Canadian dollar trust account(s) for lottery proceeds. Organizations can open a trust account for each type of lottery event or consolidating trust accounts as follows:

- An account for proceeds derived from lottery events licenced by the Registrar of Alcohol and Gaming other than break open tickets (Provincially-issued licences); and

- An account for proceeds derived from break open ticket lottery events licenced by the Registrar (Provincially-issued licences)

Organizations that are permitted to accept American currency must also maintain a separate trust account for lottery proceeds in American dollars.

The Terms and Conditions for each type of lottery event set out specific accounting requirements for journals, monthly summaries and bank reconciliation.

Please refer to the Lottery Licencing Policy Manual or the Registrar´s Standards for more information about Trust Accounts.

Consolidated designated trust accounts (CDTA)

A Hall Charities Association representing licensees conducting Charitable Gaming Events in a bingo hall where proceeds are pooled must have a Canadian dollar CDTA. Lottery proceeds raised from all charitable gaming events conducted must be deposited into this account.

Organizations that are permitted to accept American currency must also maintain a separate CDTA for lottery proceeds in American dollars.

Member organizations of a Hall Charities Association are required to have Designated Lottery Trust Accounts.

The Registrar´s Standards – Financial Management and Administration for Bingo Halls where Proceeds are Pooled – set out specific accounting requirements for books, records, journals, ledgers, monthly summaries and bank reconciliations.

Please read the “Instructions’ portion of the lottery licence application for supporting document requirements.

Bazaar

A Bazaar is an event where any combination of the following lotteries may be conducted:

- A raffle not exceeding $500 in prizes;

- A bingo not exceeding $500 in prizes; and

- A maximum of three wheels of fortune with a maximum $2 bet.

Application requirements

Please note the items listed below must be enclosed with each Licence Application (do not send separately).

- Licence Fee:

- 2% of prizes for a bingo

- 3% of prizes for a raffle

- $10 per wheel

- Completed Lottery questionnaire

- Completed AGCO bazaar licence application (PDF)

- A Copy of the preceding and current operating budget, which includes all sources of revenues and expenses

- Copy of proposed lottery budget

- A complete list and value of the prizes to be awarded for each game

- Confirmation prize donations or purchases

- A detailed description of how the winner will be determined for each game

- Sample ticket, if applicable

- Bingo program, if applicable

First-time applicants must also enclose copies of:

- Governing documents (constitution and/or by-laws, letters of patent, charter, trust deed, memorandum of association, signed as required

- Detailed Outline of programs/services (what they are, how delivered to clients, specific costs, supporting materials, etc.)

- Organization’s current operating budget

- Organization’s verified financial statements for last fiscal year

- List of Board of directors

- The latest report to the Public Guardian and Trustee, if applicable.

- Revenue Canada notification of registration letter (If your organization is registered)

- Membership list, if applicable.

- Organization’s Annual Report, if applicable.

Please contact the lottery licence officer at 613-392-2841 or deputyclerk@quintewest.ca if you require clarification on any of the above requirements. Applications can be dropped off at the lottery licence officer at the customer service counter, located on the second floor of city hall.

Bazaar terms, conditions and Reports

Bingo

Bingo is a game of chance where plates are awarded a prize or prizes for being the first to complete a specified arrangement of numbers on bingo paper, based on numbers selected at random.

Application requirements

Please note the items listed below must be enclosed with each licence application (do not send separately).

- Licence fee – 2% of the prize value

- Completed Lottery questionnaire

- Completed AGCO bingo licence application (PDF)

- A copy of the preceding and current operating budget, which includes all sources of revenues and expenses

- Copy of proposed lottery budget

- A game schedule outlining:

- The bingo games to be played

- The winning arrangement of numbers for each game

- The minimum & maximum payouts for variable prize games, also known as “share the wealth” games, including any table board bingo games

- The set percentage used to calculate the variable prizes for the individual table board games.

- The price of bingo paper, if applicable.

- The total value of all prizes offered for the bingo event

- The name and address of the premises where the bingo event is to be held.

- Any special purchase provisions for used bingo paper exchanged for the new document (e.g. $0.25 instead of $0.50)

- The starting and ending time for the time slot for the licensed regular bingo event and any bingo games played in conjunction with it, including the fixed time slot for any table board bingo games.

First-time applicants must also enclose a copy of the following:

- Governing documents (signed constitution, bylaws, letters of patent, charter, trust deed, memorandum of association)

- Detailed Outline of programs/services (What they are, how delivered to clients, specified costs, supporting materials, etc.)

- Organizations current operating budget

- Organization’s verified financial statements for last fiscal year

- List of board of directors

- The latest report to the public guardian and trustee, if applicable.

- Revenue Canada notification of registration letter (if your organization is registered)

- Membership list, if applicable.

- Organization’s annual report

If applicable. Please contact the lottery licence officer at 613-392-2841 or deputyclerk@quintewest.ca if you require clarification on any of the above requirements. Applications can be dropped off at the lottery licence officer at the customer service counter, located on the second floor of city hall.

Bingo terms, conditions and reports

Break open tickets

Break open ticket is a game of chance to win instant prizes by revealing a specified arrangement of numbers or symbols. Prizes may be instant prizes or chances to win prizes determined by a subsequent event.

Application requirements

Please note the items listed below must be enclosed with each Licence Application (do not send separately).

- Licence fee is $25/year

- Completed lottery questionnaire

- Completed AGCO break open ticket licence application (PDF)

- A copy of the preceding and current operating budget, which includes all sources of revenues and expenses

- Copy of proposed lottery budget

- Type and style or styles of tickets to be sold (ticket samples are not required).

- Number of deals of tickets to be sold

- An agreement to lease/rent/maintain or purchase a break-open ticket dispenser, if applicable.

- A copy of the break open ticket seller registration, where applicable

- The organization’s system for keeping track of sales and inventory

- A list of bona fide members assisting with the break open ticket administration and sales

First-time applicants must also enclose a copy of the following:

- Governing documents (signed constitution, bylaws, letters of patent, charter, trust deed, memorandum of association)

- Detailed outline of programs/services (What they are, how delivered to clients, specified costs, supporting materials, etc.)

- Organizations current operating budget

- Organization’s verified financial statements for last fiscal year

- List of Board of directors

- The latest report to the public guardian and trustee, if applicable.

- Revenue Canada notification of registration letter (if your organization is registered)

- Membership list, if applicable.

- Organization’s annual report, if applicable.

Please contact the lottery licence officer at 613-392-2841 or clerks@quintewest.ca if you require clarification on any of the above requirements. Applications can be dropped off to the lottery licence officer at the customer service counter, located on the second floor of city hall.

Break open ticket lottery terms, conditions and reports

Raffles

A raffle is a lottery scheme where tickets are sold to win a prize in a draw.

Application requirements

Please note the items listed below must be enclosed with each Licence Application (do not send separately).

- Licence fee – 3% of prize value (suggested retail price)

- Completed lottery questionnaire

- Completed AGCO raffle lottery licence application (PDF)

- A fully completed application must include the following:

- Location, date & time of the proposed draw (sporting event schedules may be used to provide this information for 50/50 draws to be held during sporting events)

- The price of the tickets and a sample ticket

- Total number of tickets to be printed

- Rules for the draw and the collection of prizes

- If the prize value is $1,000 or more, a financial institution’s financial guarantee is required. It must be made payable to the municipality for all prizes’ full retail value, including taxes, with an expiry date of no less than 45 days after the last draw.

- Copies of all receipts, invoices, purchase orders, bills of sales or letters of intent for prizes of $10,000 or more (including cases where multiple of the same items total more) supporting the stated retail value of the prizes, plus taxes

- A full translation of the information to be printed on the tickets and advertisements (if other than English) and a copy of the text in the languages being used

- A full explanation of how credit card sales and dishonoured cheques will be handled

- The cut-off date for the sale of tickets by cheques and credit cards

- A complete list of prizes, with their full retail value (plus taxes) and a detailed description of the prize’s sequence, draws and, in the case of 50/50 draws, the prize’s maximum amount.

A municipality may also request the following from applicants:

- A business plan and budget for the raffle lottery

- A detailed ticket sales plan, including where, when and how sales will take place

- Any documentation deemed necessary by the municipality.

- Organization’s verified financial statements for last fiscal year

- A description of all the services to be obtained from each supplier

- List of Board of Directors

- The latest report to the public guardian and trustee, if applicable.

- Revenue Canada notification or registration letter (if your organization is registered)

- Membership list, if applicable.

- Copy of preceding and current operating budget, which includes all sources of revenues and expenses.

First-time applicants must also enclose a copy of the following:

- Governing documents (signed constitution, by-laws, letters of patent, charter, trust deed, memorandum of association)

- Detailed outline of programs/services (What they are, how delivered to clients, specified costs, supporting materials, etc.)

- Organizations current operating budget

- Organization’s verified financial statements for last fiscal year

- List of Board of directors

- The latest report to the public guardian and trustee, if applicable.

- Revenue Canada notification of registration letter (if your organization is registered)

- Membership list, if applicable.

- Organization’s annual report, if applicable.

Please contact the lottery licence officer at 613-392-2841 or deputyclerk@quintewest.ca if you require clarification on any of the above requirements. Applications can be dropped off to the lottery licence officer at the customer service counter, located on the second floor of city hall.

Raffle Lottery Checklist, Terms & Conditions and Reports

Checklist to assist in holding a raffle

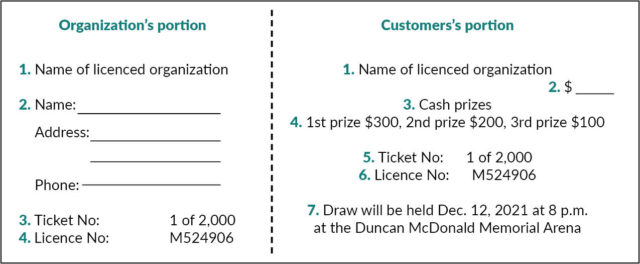

The following information must be printed on the stub of the ticket (organization’s portion):

- Name of the licenced organization

- Adequate space for the name, address, and telephone number of the ticket purchaser

- Number of ticket and of tickets printed (example: 1 of 100)

- Lottery licence number

The following information must be printed on the face of each ticket (customer portion):

- Name of the licenced organization

- Price of the ticket(s)

- Detailed description of the prize(s) – Must be very specific (example: Sony 52” Plasma HD TV)

- Value of the prize(s)

- Number of ticket and of tickets printed (example: 1 of 100)

- Lottery licence number

- Location, draw date, and time of the draw(s)

The following information must be supplied to the municipality after the draw has been completed:

- Completed report

- List of winners and their telephone numbers

- Copy of advertisements

- Copy of deposit slip(s)

- Copy of bank statement showing where deposit(s) was entered

- Copy of any cheques written for expenses

- Copy of any bills/invoices paid

- Copies of cheques written for donations

Things to remember when holding a raffle:

- The market retail value of the prize(s) to be awarded shall not be less than 20% of the anticipated gross proceeds from sale of the tickets

- All tickets printed are to be held for one year – both the sold tickets and the unsold tickets

- The lottery report is due 30 days from the date the event was held

Other Licences:

If you operate a business such as a refreshment vehicle, lodging house, or a vendor in a special sale or hobby show in the City of Quinte West, you may require a business licence to operate. Visit our business licences page for more information and apply it.

If you are a resident who owns a dog, has a kennel with six or more dogs or has a hen coop, you may require a licence. Visit our animals and pets for more information and apply it.

If you plan on getting married in Ontario, you must get a marriage licence before you get married. A licence is only valid for 90 days, so you must apply for your marriage license within three months of the day you plan to get married. For more information on marriage licenses or to apply, visit our marriages and oath page.